How to Think About Wallets as a Stablecoin Issuer

Stablecoins are booming. Major tech firms, banks, and fintechs are launching their own stablecoins to improve payments and gain more control. With so many new stablecoins entering the market, the real competition is shifting to distribution: who can get their stablecoin into the most users’ hands.

A stablecoin’s success no longer depends just on its technical design or reserves, but on how easily users can access and use it. Some early stablecoins have grown quickly thanks to the distribution power of their issuers’ brands, but brand alone isn’t enough to scale. For most issuers, it comes down to one thing: wallets. If you don’t own your wallet strategy, you don’t own adoption.

The Stablecoin Distribution Challenge

- Issuance is easy, adoption is hard.

- Launching a token is just step one; getting people to actually hold and use it is the real battle.

- Stablecoins only matter if they circulate.

- If users can’t easily acquire, hold, and spend them, the token is just an idle balance sheet entry.

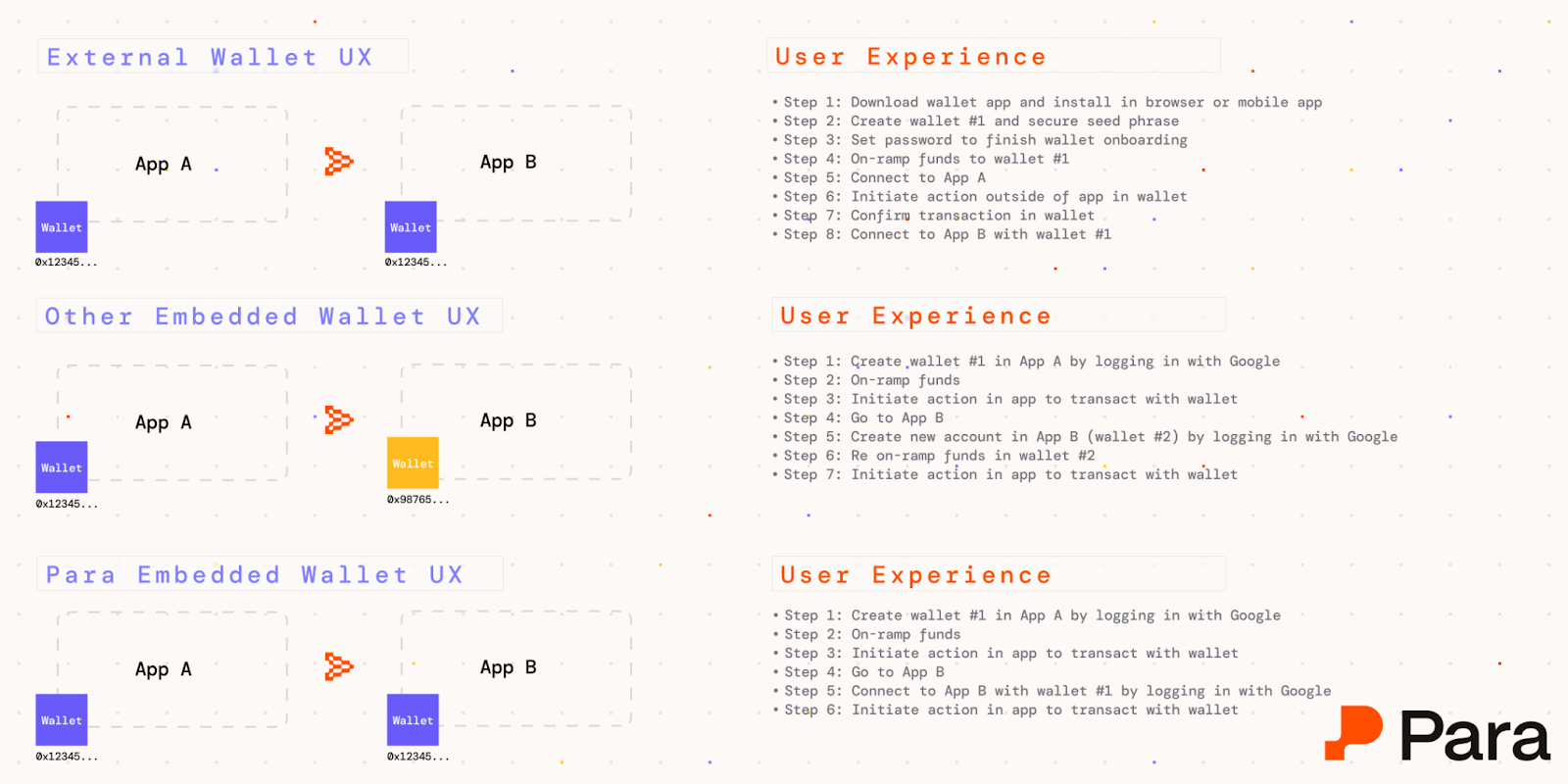

- Stablecoins gain utility only when they are widely held and actively used, which requires easy access inside the wallets and apps people already trust. That’s why embedded wallets are critical: they remove the friction of setup and make stablecoins feel as seamless as digital cash. In practice, distribution starts at the wallet layer.

- Apps like Noble Express make this concrete by giving users a direct, wallet-native way to access and move stablecoins across the Noble ecosystem, without requiring separate wallet setup or manual bridging.

- Wallets are the gateway.

- Just as checking accounts are the access layer for dollars, wallets are the access layer for stablecoins. Without them, your distribution is capped from day one.

Why Wallet Infrastructure Matters

With embedded wallet infrastructure, every fintech account, every app login, and every user onboarding can silently create a wallet under the hood. Suddenly, any payments app, rewards program, or game can distribute your stablecoin without the user ever needing to download a crypto app.

Security Builds Trust

For regulators and institutions, wallets are the anchor point of risk.

Non-custodial wallet infrastructure can give stablecoin issuers day-one support for new chains, DeFi protocols, and onchain primitives, ensuring their tokens remain usable wherever innovation happens. The combination of enterprise security and non-custodial flexibility is what makes wallets the anchor layer for stablecoin adoption.

Composability Removes Fragmentation

In the fiat context, $1 always equals $1. In the stablecoin context, 1 USDC ≠ 1 USDT ≠ 1 USDG and fragmentation breaks network effects. Users don’t feel composability unless wallets abstract it away. Embedded wallets make stablecoins interchangeable at the UX layer, delivering a “digital dollar” experience where the underlying token doesn’t matter.

Stablecoins like Mynt USD highlight why this abstraction matters: issuer credibility and reserves are table stakes, but real adoption depends on whether users can acquire, hold, and spend the token seamlessly inside the wallets and apps they already use.

Much like how L2s fragmented liquidity, the rise of multiple stablecoins risks fragmenting value. Each new token creates silos, making it harder for users and apps to treat digital dollars as interchangeable. Users shouldn’t need to worry about which blockchain your stablecoin runs on, so that sending stablecoins feels as simple as sending a venmo payment.

How to build a Wallet-Centric Stablecoin Strategy

- Instant Wallet Provisioning: Ensure each user can get a wallet easily and immediately. Ideally, wallets should be created at the moment of user onboarding (or even in advance). This way, as soon as someone engages, they’re ready to transact. Removing the extra step of “set up a wallet” can significantly improve conversion.

- Example: Embedded wallet solutions like Para enable non-custodial wallet creation at the moment of onboarding, dramatically improving conversion.

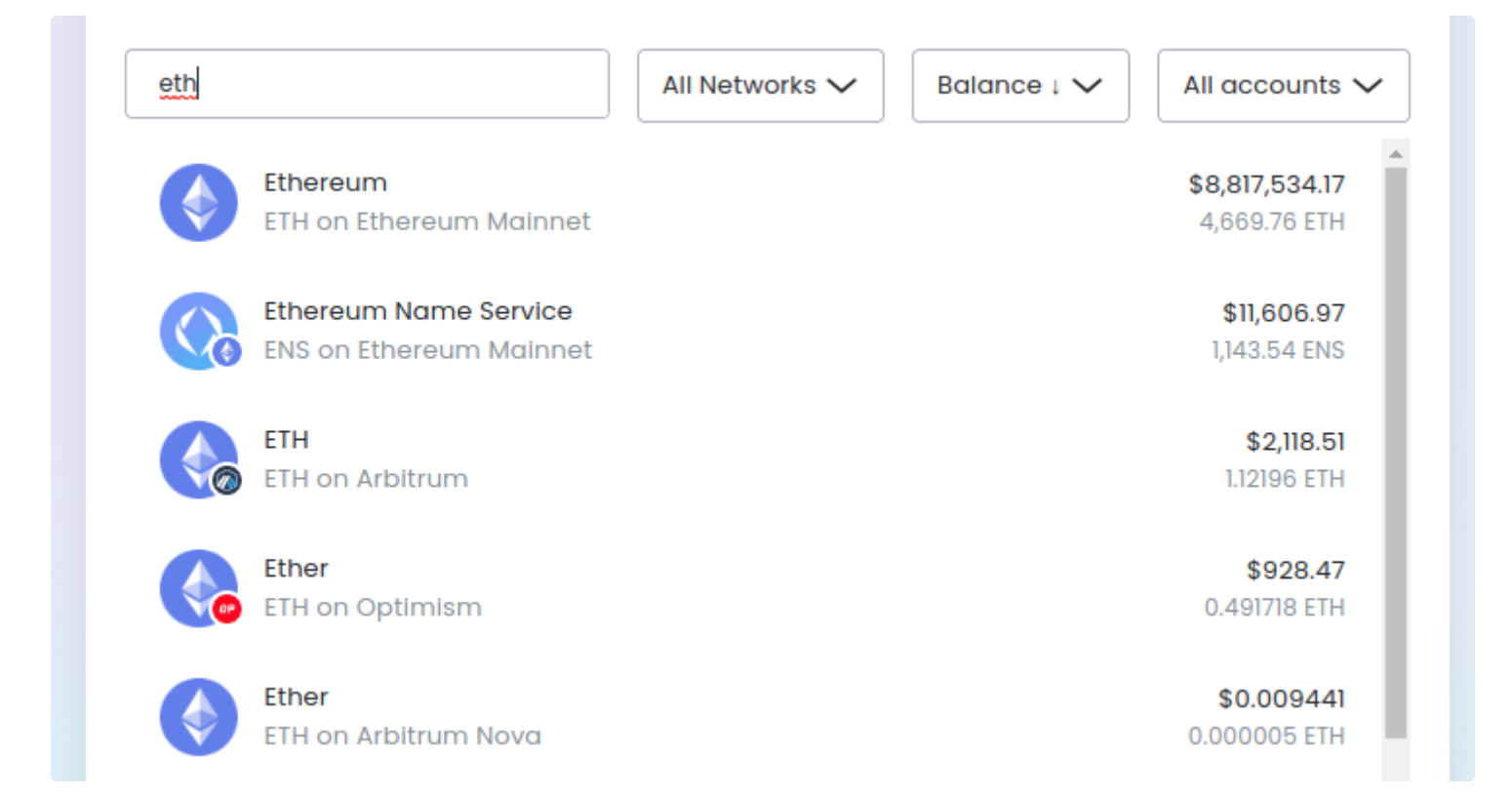

- Multi-Chain & Cross-Chain Support: Many stablecoins operate on multiple blockchains (for liquidity and reach), or may migrate to new chains over time. Your wallet infrastructure should abstract away the complexity of multiple networks. Users shouldn’t need to know whether they’re using Ethereum, Solana, or another chain.

- Security at Scale: As adoption grows wallets must deliver bank-grade security with features like multi-party computation (MPC) key management, programmable policies, and transaction monitoring. Combined with SOC 2–level compliance, this gives both regulators and users confidence that your stablecoin can scale safely.

How Para Accelerates Stablecoin Distribution

Para delivers a universal embedded wallet SDK designed for scale.

- Auto-Created Wallets at Scale: Para’s SDK allows you to instantly generate a non-custodial crypto wallet for every user of your app. As soon as a user signs up or logs in (via email, Google, Apple ID, etc.), a wallet is created behind the scenes. There are no seed phrases for the user to manage and no browser extensions required, dramatically lowering the entry barrier and ensuring every one of your customers is “wallet-ready” for stablecoin transactions.

- White-Label UX: With Para, the embedded wallet fully blends into your product’s look and feel. You can customize the wallet UI components to match your brand so users experience a smooth interface to send, receive, and view stablecoin balances in-app. By keeping users in your app’s environment, you avoid the drop-offs that happen when people are forced to switch to external wallets or deal with clunky pop-ups.

- Compliance and Control: Para provides enterprise-grade compliance features out of the box. The platform is SOC 2 Type II compliant and offers hooks to integrate with your preferred KYC/AML providers.

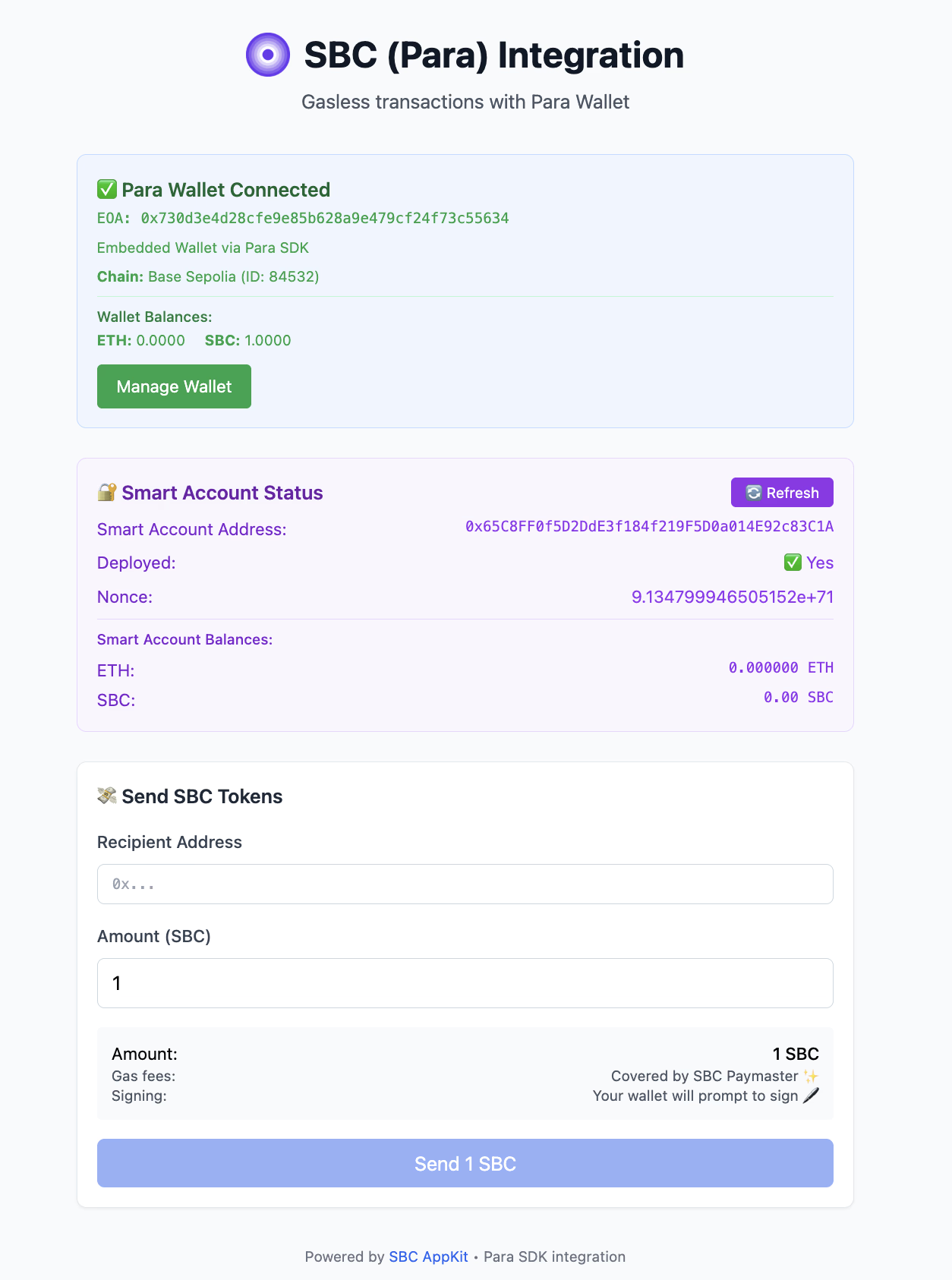

How Para Accelerates Stablecoin Distribution: SBC Example

At Brale’s recent Day Zero conference, the SBC team established how an embedded wallet toolkit can jumpstart a stablecoin’s ecosystem. In the “First 5 Things When You Launch A Stablecoin” workshop, Jeff Milewski, CEO and Co-founder of SBC, demonstrated how a Para + SBC AppKit integration lets issuers generate Para wallets preconfigured with SBC’s paymaster. This setup enables gasless stablecoin transactions out of the box, so new projects can onboard users immediately without the usual friction of wallet setup or gas fees.

The Bottom Line

If you’re issuing a stablecoin, your competitive edge is not just reserves or regulation—it’s distribution at the wallet layer.

Issuers who lock in wallet infrastructure now will capture adoption. Issuers who ignore it will lose market share to those who make stablecoins invisible, accessible, and trusted.

That’s why stablecoin issuers—from early-stage networks to enterprise-scale projects—partner with Para.

Because without wallets, stablecoins don’t move.

Issuing a stablecoin? Start with the wallet layer: Contact us or get started