From Onboarding to Yield: The Stablecoin Stack for Fintechs with Aave + Para

Together, they form a full-stack stablecoin infrastructure that lets fintechs launch fast, scale globally, and offer users consistent yield with a seamless UX.

The Missing Middle in Stablecoin Apps

Fintechs are ready for stablecoins: faster payments, borderless access, and programmable money movement that opens the door to entirely new products, markets, and revenue models.

The challenge is that real-world products need more than just a token. They require safe infrastructure with user-friendly wallets, liquidity rails that developers can integrate in days (not weeks), and compliance frameworks trusted by institutions.

When these layers connect, they form a self-reinforcing flywheel: Onboarding through embedded wallets brings users in with minimal friction. Liquidity then activates their balances, turning idle value into working capital. Yield keeps those balances in the system, rewarding continued engagement. Automation ensures money moves constantly in the background. Together, these forces create a cycle that strengthens with every new user, driving compounding network effects where each transaction makes the whole ecosystem stickier and more resilient.

Liquidity Needs Distribution

Open finance protocols like Aave provide the foundational infrastructure for composable, programmable liquidity at scale. As the world’s largest and most battle tested crypto and stablecoin liquidity protocol, managing over $50 billion in assets and up to 90% of stablecoin and 60% of BTC liquidity, Aave enables seamless access to borrowing and yield strategies for both users and developers.

Stable yields are essential for those looking to integrate DeFi in the backend. Aave’s deep liquidity allows it to handle significant single-transaction deposits or withdrawals, hundreds of millions without causing rate swings. This stability is critical for fintechs routing users into DeFi products: if a fintech markets a certain yield, it must deliver on it. Sudden drops, like a 50% cut at launch because of thin markets, can destroy trust and damage the brand. With Aave, deep liquidity ensures user yields remain consistent, even during large inflows.By abstracting away complexity and unlocking safe, scalable, stablecoin liquidity, Aave’s infrastructure empowers integrators to embed borrowing, lending, and yield primitives directly into their products.

This infrastructure creates a new programmable backend for consumer finance, one that is borderless, efficient, and built for the internet economy. Compared to building traditional treasury or cash management systems in-house or needing to liaise with a bank backend, integrating Aave offers a faster, lighter-weight alternative designed for scale.

But capital infrastructure alone doesn’t onboard users. To reach users at scale, liquidity needs a distribution layer, the point where end users actually interact with it. That’s where Para’s embedded wallet infrastructure comes in.

Connect users to onchain liquidity for lending, borrowing, yield, and payments

The Integrated Stablecoin Stack

Para provides MPC-secured wallet infrastructure that allows fintechs to:

- Instantly generate white-labeled, non-custodial wallets

- Easily connect users to onchain liquidity for lending, borrowing, yield, and payments

- Enforce permissions and transaction policies for compliance

In practice, Para acts as a distribution layer, handling account creation, and money movement through secure, programmable wallets and abstracting away the complexity of onchain finance while keeping its benefits intact.

With Para, fintechs can plug directly into protocols like Aave and deliver their capabilities inside intuitive, branded user experiences, without requiring customers to learn crypto infrastructure or manage private keys.

The result is an integrated stack: Aave powers the capital layer, Para powers the distribution layer, enabling fintechs to deploy stablecoin-enabled products that are fast, compliant, and scalable from day one.

For developers, integration is straightforward. Para abstracts away key management, transaction handling, and wallet UX, while Aave’s SDKs and APIs make it simple to embed borrowing, lending, and yield mechanics directly into your product. Move from prototype to production without building complex blockchain infrastructure from scratch.

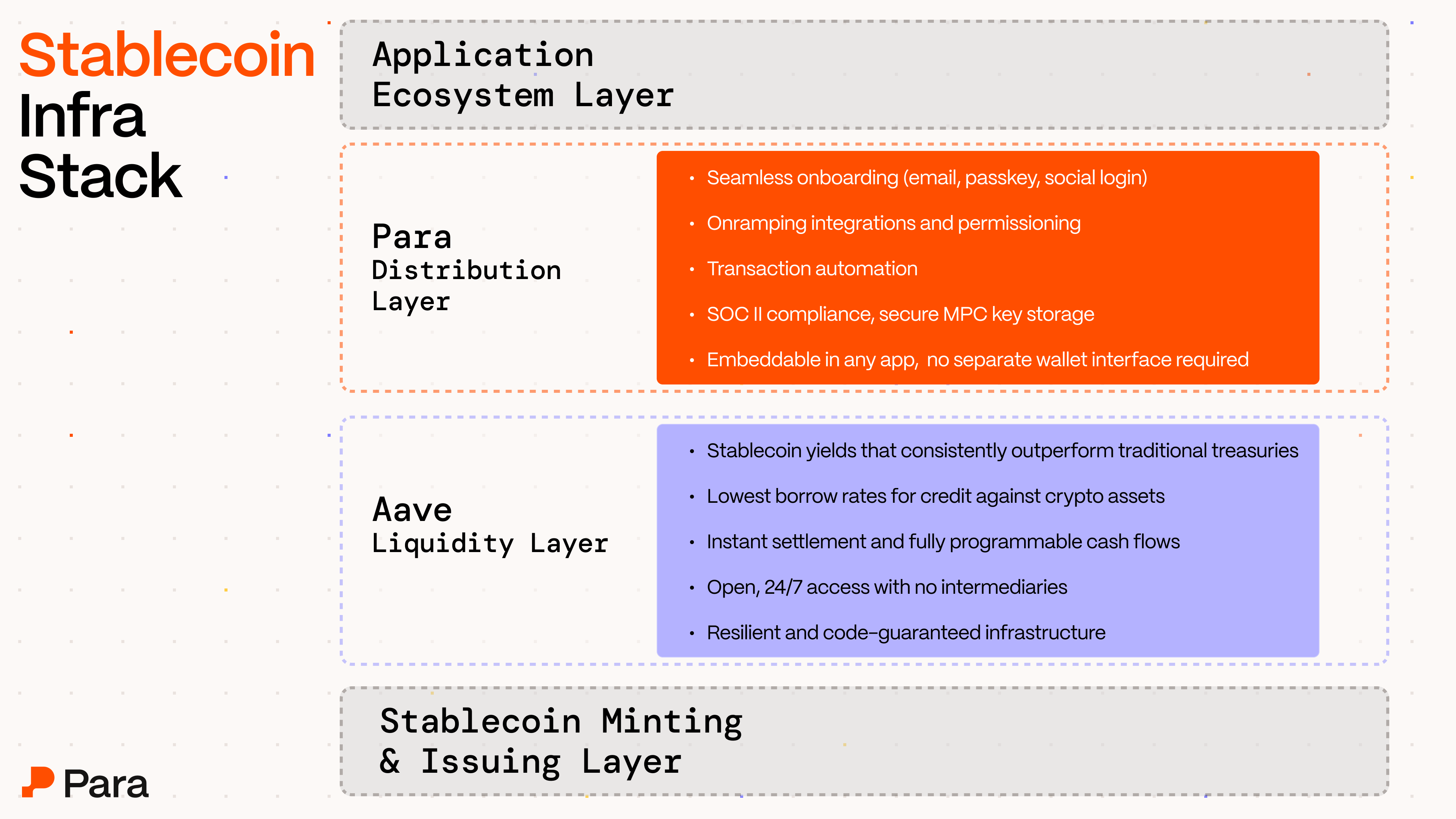

What does a Full Stablecoin Infra Stack Look Like?

To build a stablecoin ecosystem, you need a composable infrastructure stack that connects user-friendly frontends to deep, programmable liquidity (without adding operational complexity).

By offering this combination, apps can create a UX friendly and compelling reason for users to store value in their product, boosting stickiness and long-term engagement. When these layers work together, they enable entirely new categories of financial products.

The Stablecoin Infra Stack Unlock

A composable stack unlocks a new generation of financial products, including updates to:

- Neobanks: Offer native yield on user deposits, rewards, and even issue branded stablecoins. Onboard users instantly, enforce permissions, and plug directly into yield marketplaces, without exposing users to crypto complexity.

- Trading Apps: Generate working capital by ensuring that idle balances are always earning yield. Funds can also be used as collateral for short-term financing, unlocking capital efficiency for businesses.

- Payments: Para-powered wallets can generate yield passively by auto-depositing into Aave. Yield is compounded in real time down to the second: every dollar becomes an active asset, earning while awaiting transfer, clearing, or redemption, and turning financial products into both money movers and money growers.

Composable Fintech Layers

If you’re building a stablecoin-powered app, start by thinking in composable layers, each handling a critical part of the stack without locking you into a monolithic solution.

Para powers distribution and wallets; Aave powers liquidity and yield.

Building with Aave’s SDKs and APIs is now easier than ever. Para’s SOC 2 Type II certified developer tooling abstracts away key management, transaction handling, and wallet UX, making it seamless to embed Aave’s liquidity and yield mechanics directly into your product.

With this modular approach, fintech teams can combine proven infrastructure instead of reinventing it.

Interested in integrating Aave + Para into your product? Check out the developer docs or get in touch!