Para for Fintechs: Build and Scale with Stablecoins

Stablecoins are ready for prime time in fintech. They offer faster settlement, lower costs, and programmable logic that traditional payment rails can’t match. For fintech teams, they unlock new possibilities: from global payments to 24/7 asset access.

Why do Fintechs need Embedded Wallets?

But to actually unlock these benefits at enterprise scale, stablecoins need to live inside embedded wallets. Every balance, transaction, and policy runs through a wallet. The question is whether that wallet experience is outsourced to a third-party app, or is owned and embedded directly into your product.

For enterprises, wallets aren't just "addresses on a chain." They are the rails that control user onboarding, payments, compliance, and universal UX. Without embedded wallet infrastructure, you lose control:

- Users are pushed into UX outside of your app

- Your brand disappears at the point of a transaction

- Scale becomes bottlenecked by crypto-native friction

The challenge isn't stablecoins – it's everything around them. Wallets are fragmented across chains, liquidity is siloed, and compliance and risk controls are brittle and manual.

Para reduces complexity. We give fintechs the full-stack infrastructure to launch and scale stablecoin-enabled products. Manage wallets, money movement, and cross-network payments all in one place.

Why Stablecoins?

Traditional fintech infrastructure wasn’t built for programmable stablecoins. Legacy systems rely on closed loops: siloed providers, delayed settlements, and opaque intermediaries. Stablecoins operate in open loops, but taking advantage of that requires new infrastructure.

What’s missing from today’s stablecoin infrastructure

- Wallets are often fragmented across chains, each with its own UX and signing flow

- There’s no standard way to move stablecoins between apps or ecosystems

- Compliance is an afterthought, often handled manually or bolted on too late

%20(1).gif?raw=true)

For fintechs and enterprises, wallets become the primary distribution layer. An embedded wallet becomes the account, ledger, and the policy engine all at once. Without it, you cannot:

- Extend your brand identity into onchain money movement

- Offer seamless user experiences without crypto-native friction like seed phrases or browser extensions

- Bake in compliance and transaction policies at scale

Para closes these gaps. It gives fintechs the infrastructure to treat stablecoins as a native primitive: from wallet creation to transaction routing to policy enforcement.

Para: An Infrastructure Solution for Stablecoin Fintech

Onchain experiences all begin with the wallet – the foundation that enables stablecoins to power enterprise-grade products.

Wallet Infra that Performs

Para powers instant, invisible onboarding with sub-second signing and wallets secured with distributed MPC.

- Production-grade server wallets

- Chain-agnostic, with SSO and key export options

- Live across EVM, Solana, and 100+ chains

Integrated Money Movement

Liquidity is built into the wallet layer, making movement seamless across assets and jurisdictions.

- Native support for fiat ↔ stablecoin flows

- Built-in bridges and on/off-ramps

- Automated routing across stablecoins and chains

.gif?raw=true)

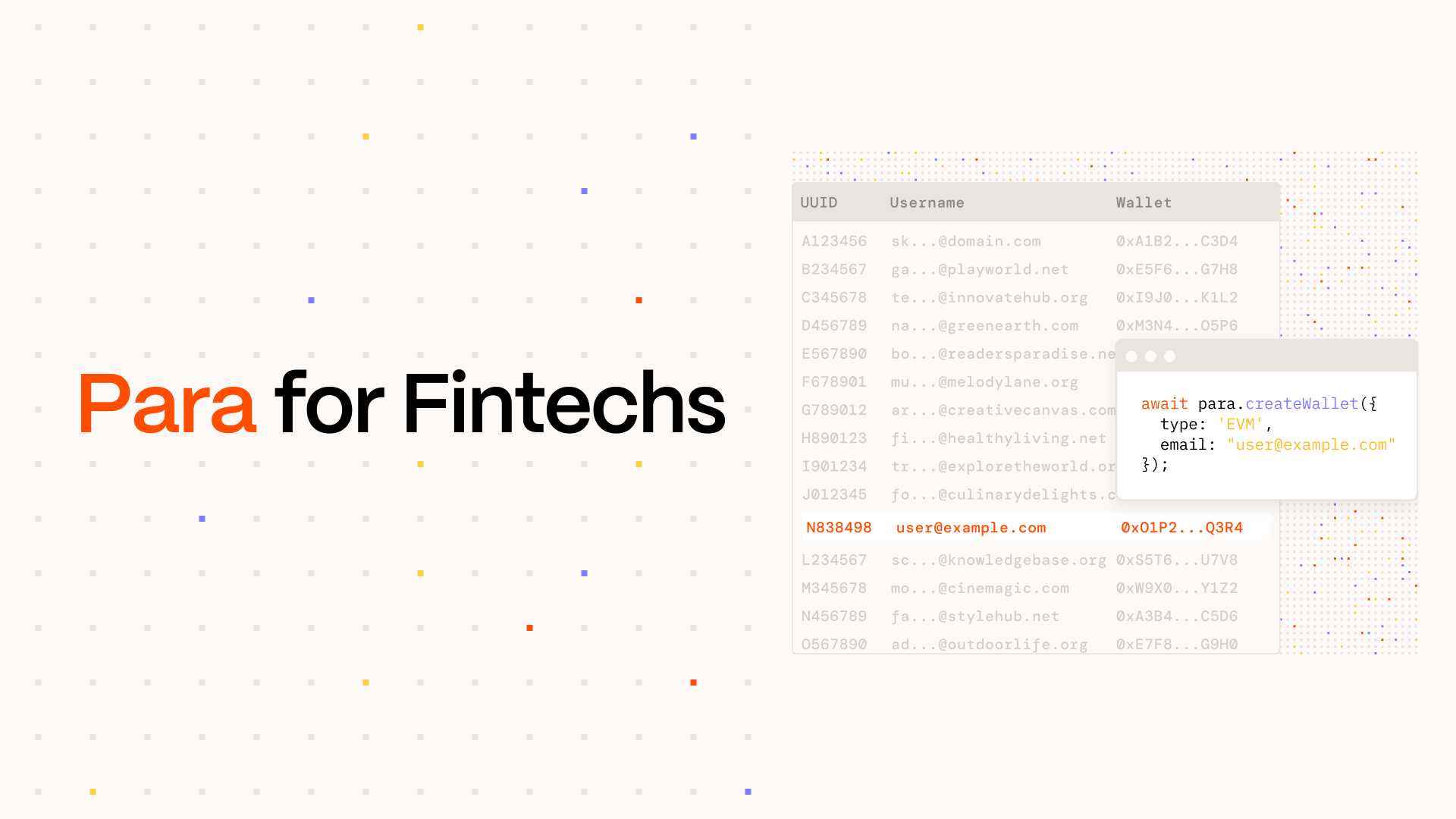

Powerful Wallet APIs

Manage thousands of wallets through a single API surface, with full control and observability.

- Create, monitor, and manage wallets at scale

- Fully customizable white-labeled themes

- Optimized for developer speed and clean integration

Policies and Risk Controls

Enforce business logic and compliance at the wallet layer.

- Custom transaction policies: block, delay, hold, approve

- Compatible with on- and off-chain KYC systems

- Built to streamline audits

Para for Fintechs: Use Cases

Para supports the full spectrum of stablecoin-enabled financial products: whether you’re building for consumers, institutions, or global markets.

Trading & Asset Management

Offer 24/7 access to tokenized assets, from crypto to RWAs. Para makes it easy to spin up wallets, custody assets, and enable secure trading across chains.

Payments & Payouts

Enable global pay-ins, real-time payouts, and stablecoin invoicing. Para handles the wallet logic and the liquidity flow behind the scenes.

Global Coverage & International Expansion

Launch cross-border financial products without piecing together multiple providers. Para’s infrastructure is built for global reach: On/off-ramps, FX routing, and jurisdiction-aware flows included.

Why Choose Para for Your Fintech Application

Enterprises don't adopt stablecoins for speed alone. They need infrastructure that embeds wallets seamlessly into their products and scales globally without losing control.

Para is engineered for production-grade fintech. From architecture to audits, every layer is built to meet the demands of serious teams shipping real money products.

SOC 2 Type II Certified

- Para meets the highest standards for data security, availability, and privacy trusted by enterprise partners across sectors.

Audited and Battle-Tested

- Para’s infrastructure is regularly audited by leading firms and powers live apps and ecosystems.

MPC Protected and Non-Custodial

- Keys are never stored in one place. Para uses MPC Distributed Key Generation and threshold signing to eliminate single points of failure.

- Para doesn’t hold your users’ keys. Wallets are fully non-custodial and censorship-resistant, with export options and flexible SSO authentication.

Whether you're launching a stablecoin wallet, global payout flow, or onchain treasury system, Para helps you go from prototype to production fast.

Want to integrate Para into your fintech product? Get started or get in touch!