Part I: How Stablecoins Can Power the Next Generation of Fintech

This article serves as an introduction to what stablecoins are and why they matter for fintechs.

Fintech is outgrowing the bank rails it was built on. Stablecoins are at the forefront of that shift, not just as a crypto-native payment rail but as a programmable financial layer that traditional systems cannot match.

More than new forms of money, stablecoins are an entirely new canvas for designing financial products. They’re digital dollars that settle in seconds, integrate natively into apps, and operate across an open ecosystem.

For fintech teams, stablecoins open up a radically more flexible architecture:

- Real time settlements instead of batch processing

- Global interoperability without partner banks

- Embedded financial logic instead of middleware

What Are Stablecoins

At their core, stablecoins are digital assets that are pegged to fiat currency (such as the US dollar). Their real differentiator isn’t just the peg, but also where they live.

Stablecoins operate on open and composable blockchains, where assets and apps can interact natively. It is this difference that is changing how financial services are built, delivered, and connected.

Stablecoins shift value from being a balance in a database to being an interoperable building block. They’re accessible across apps and composable by design. However, unlocking this design space to its full potential requires infrastructure that matches the opportunity: wallets.

Why Wallets Matter for Stablecoins

In crypto, wallets are more than private key storage. As the interface for users to log in, access assets, and move money, wallets are critical to the stablecoin experience.

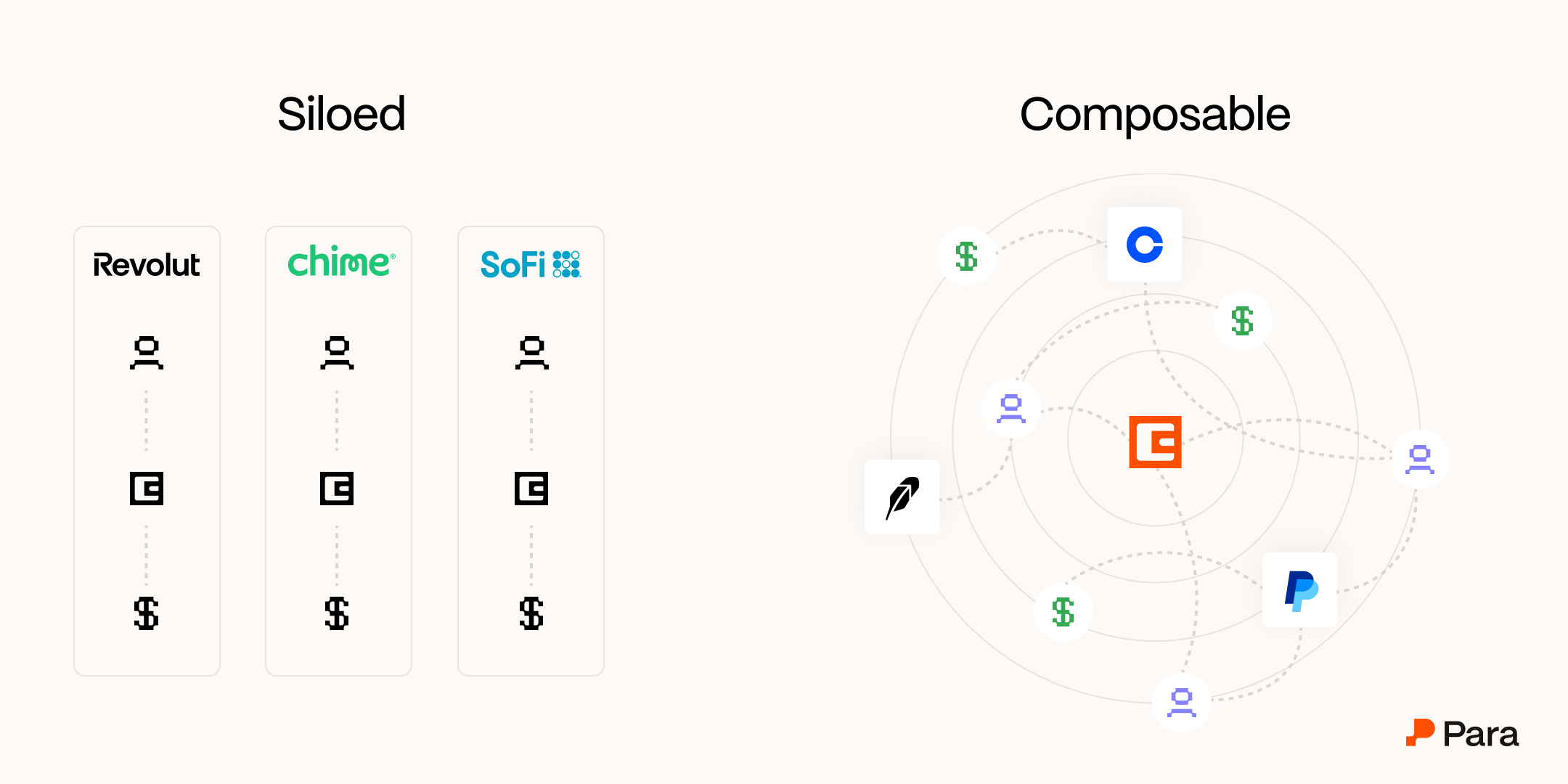

Without the right wallet infrastructure, stablecoins replicate the worst aspects of fiat currency: fragmented balances, repeated onboarding, and siloed capital.

Composability: The Real Fintech Superpower

Most fintechs still build silos: one app, built with one stack, tied to one wallet. This model gives companies control, but at a cost. Users face repeated onboarding, capital can get stuck in apps, and fragmented user experience.

The result? Wasted capital and thinner margins. The lack of shared infrastructure leads to idle balances and duplicative systems, limiting how efficiently money moves and value is created.

Stablecoins enable something more powerful: strategic composability. Infrastructure connects under the hood, while the user experience adapts to context and preference.

In this model, moving money feels seamless:

- A wallet from one app works in another

- Liquidity moves with the user, instead of between silos

- Financial logic is portable, so use cases expand without rewriting infrastructure

You can see the contrast in today’s landscape:

- Venmo, Cash App, and Zelle don’t talk to each other, but do similar things

- Chime, SoFi, and Revolut offer modern UIs, but little composability across ecosystems

For fintechs, stablecoins can drive retention, expand surface area, and reduce friction across product lines. What used to take months of partner integrations and compliance checks can now happen in days, with flows that are programmable, auditable, and composable by default.

Fintech giants are starting to take notice. Robinhood is building an L2 with Arbitrum. Sony is launching its own L2, Soneium. Paypal launched PYUSD, a stablecoin natively issued on Ethereum and recently expanded to Solana, bringing real-time settlement to 400M+ accounts. These are not crypto-native teams; they are fintech giants recognizing that open infrastructure can unlock better UX, better margins, and bigger networks.

Stablecoins as Ecosystems

We’re entering a phase where stablecoins don’t just sit in wallets—they enable full financial experiences.

We’re seeing the early signs already:

- Sky (formerly DAI), pioneered the concept of digital dollars backed by onchain collateral and has enabled a wide range of programmable financial products, from automated lending protocols to real-time payments.

- Coinbase and others now offer rewards that auto-deploy idle stablecoin balances to earn yield for users and developers.

- Programmable financial behavior is expanding beyond crypto: tokenized stocks from platforms like Robinhood hint at a future where traditional assets can plug into onchain logic and move across applications

- Commerce layers run tipping, subscriptions, and invoicing natively on stablecoins, like PyUSD on Solana.

- Borderless, crypto-first neobanks are using stablecoins to eliminate friction between onchain balances and real-world spending.

Robinhood (L2) - Robinhood

— rip.eth (@ripdoteth) June 30, 2025

World Chain (L2) - Sam Altman (OpenAI)

Jovay (L2) - Ant Digital (Alibaba)

Soneium (L2) - Sony

Memento (L2) - Deutsche Bank

Base (L2) - Coinbase

Ink (L2) - Kraken

ethereum is the internet of value

The next wave of fintech won’t be defined by walled gardens. It’ll be driven by ecosystems in which new apps strengthen the network around it.

Robinhood and Sony aren’t just experimenting with crypto—they’re betting on composability. The winners will be those who build into open networks, where user liquidity, credentials, and logic move freely.

Event ended

— David Hoffman (@TrustlessState) June 30, 2025

Overall takeaways

- tokenized PRIVATE companies blew past my own expectations

- Robinhood has an even tighter financial ecosystem than Coinbase

- Robinhood has a chance to leapfrog Coinbase with onchain equities because it’s already a broker dealer and releasing… https://t.co/8IRtmmbl2l pic.twitter.com/F7GIqmvyOW

What’s Next for Stablecoins?

Stablecoins are already reshaping the financial stack. As more banks and fintechs adopt them, money itself will become the platform: programmable, composable, and shared across use cases.

The real unlock won’t come from any one app, it’ll come from the network they create together.

Para helps build out the connective layer for that network. If you're building a money app with stablecoins, we’d love to chat about your stablecoin strategy.