Part II: The Two Stablecoin Futures - Fragmentation or Composability

This article was originally posted on Nitya Subramanian's blog

Over the last month, stablecoins have been the meta. Across financial institutions and major ecommerce companies, crypto seems to have finally found a legitimate claim to value add, via stables.

Deservedly so. The volumes are staggering- with nearly $4T in total transaction volume and over $250B in circulation. Fortune 500s are seriously looking at the foundational value props of crypto. This could very well be the catalyzing moment we look back on as the tipping point of finance — if we play our cards right.

We’re at a critical fork in the road- stablecoins can either be the trojan horse for a more open internet— or a replay of the same problems.

The fork in the road is composability.

Stablecoins: The Good, The Bad, and The Ugly

But first, why stablecoins? Stablecoins are fundamentally an open, intermediary-free unit of account representing fiat. This presents some great benefits:

- no “business hours”: stablecoins can be transferred at any time

- near-zero asset transfer fees: stablecoins compress interchange, wire transfer, processor fees, etc to near-zero. However, these onchain transfer fees can be misleading, as they dont always tell the full story of point A → B cost, especially for consumers. More on that later

- because stablecoins are almost always collateralized/backed with 1:1 fiat deposits, exchange rate risk is mitigated.

The Fragmentation We’re Racing Toward

However, here’s how stablecoins are being implemented today:

- Stablecoin sprawl- PayPal’s PYUSD, Visa’s USDC settlements, retailer‑backed dollars in the works, each with its own wallet. In the fiat world, USD is USD. With stablecoins, consumers have to think about USDC/USDG/USDT/etc etc

- UX overload- Six balances, six log‑ins, six KYC flows. Consumers already delete banking apps that ask for two extra taps.

- Capital trapped in silo’d wallets- Merchants and treasurers need to pre‑fund liquidity in every ecosystem they support, leaving billions stranded in float. This is the “scattered dust” problem crypto-natives are familiar with.

- Multiple balances & log‑ins- Consumers will need to manage wallets, seed phrases, and KYC flows for every new financial service they interact with

- Integration fatigue- Every branded coin adds a new checkout button, reconciliation file, and fraud model.

Most importantly, all this stranded liquidity kneecaps the network effects that are why stablecoins are onchain to begin with. Closed loop systems can hope to grow linearly, but the real opportunity here is building on exponentially compounding open rails.

The challenge in all of this: consumers, merchants, and even stablecoin issuers stand to leave the vast majority of their value on the table.

What This Means

Further, stablecoins are a decentralizing force- fees will go down as pressure builds to redistribute interest. The natural tendency here will be towards vertical ownership - owning every layer in the stack is essential to avoid leaking margins to external providers.

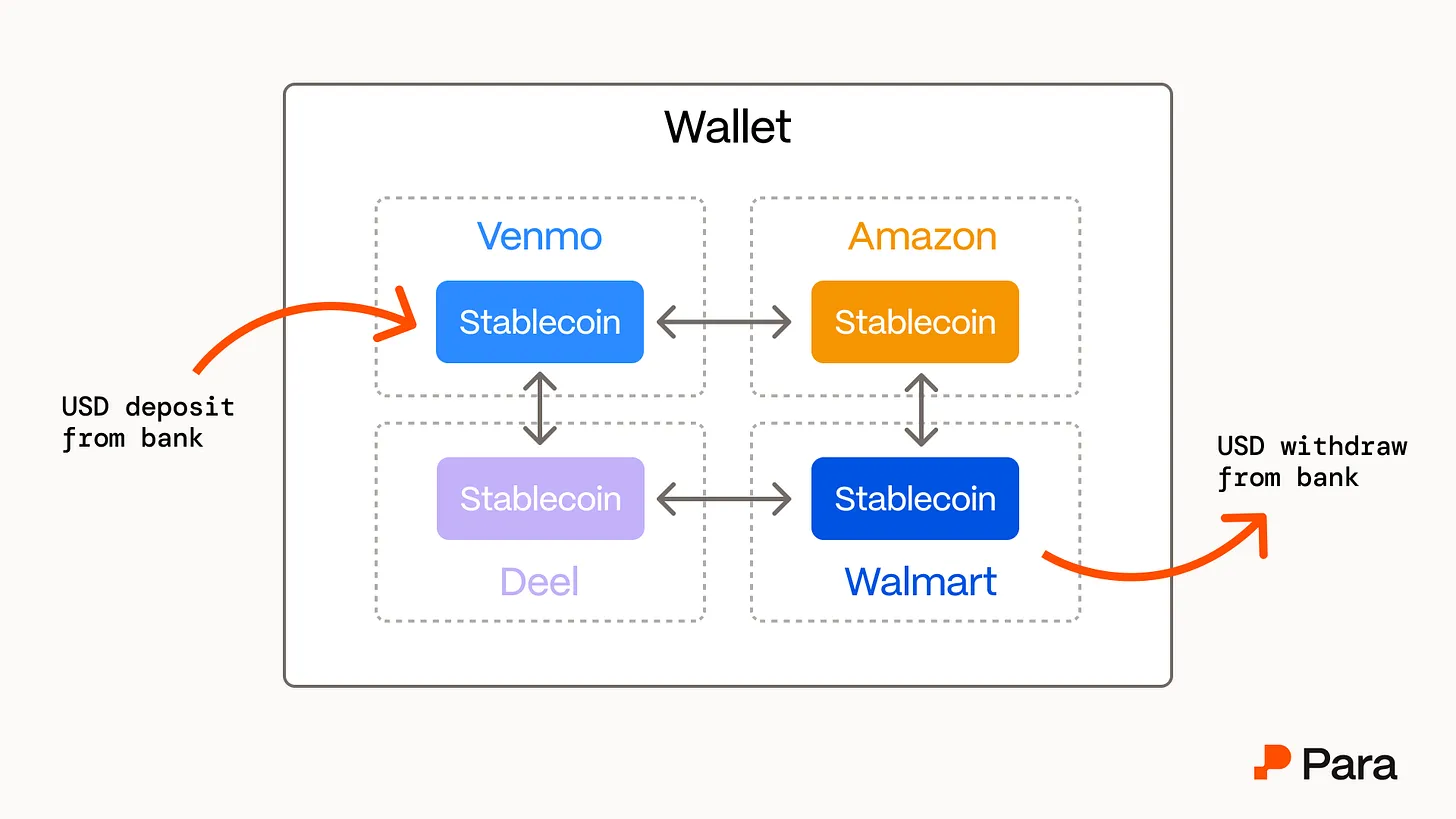

The Universal Wallet

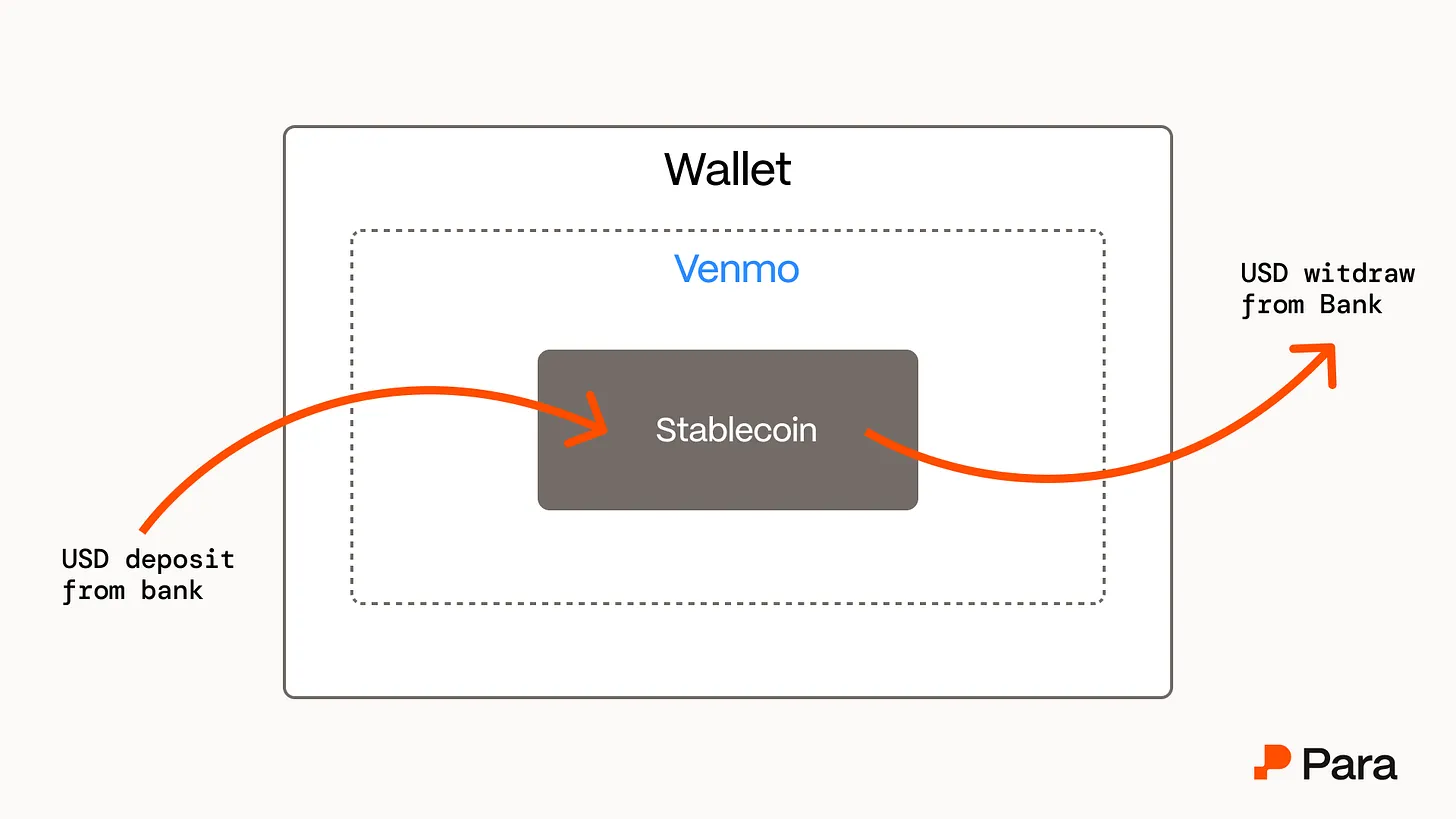

Universal wallets can be the solution to this fragmentation. Universal wallets aggregate value for consumers, preserving composability and usability. Some examples:

- KYC once, prove it everywhere: Instead of repeating KYC everywhere, credentials attached to universal wallets allow users to prove who they are when needed.

- Leverage (and access) on-chain cashflows to qualify for better lending rates- a more transparent equivalent to being forced to direct-deposit to a given bank to qualify for preferred rates.

Everyone Wins

- Consumers: fewer steps, lower fees, global reach.

- Merchants: one integration, faster settlement, reduced chargebacks.

- Stablecoin issuers: bigger addressable market; focus on treasury and yield, not distribution.

- Developers: “write once, run anywhere” money APIs unlock new products: loyalty swaps, streaming payroll, programmable invoices.

Imagine Signing in with Venmo to pay an invoice, or sending your yield interest directly to pay off the interest on your car loan.

Why Now

We’re at a very specific crux in adoption- leaning in on composability positions stablecoins to bring crypto’s values to the internet: user ownership and a universal UX made possible by interoperability

- Blue‑chip adoption. Visa settles treasury flows in USDC; PayPal’s PYUSD now moves cross‑chain - we’re at the critical moment where fragmentation of stablecoins is beginning, and at the precise point where wallet interoperability will allow stables to reach exit velocity

- Capital scale. Stablecoins have cleared $250 B in supply and are compounding at double‑digit rates.

Where Para Fits In

Para is the neutral wallet layer: one SDK, one compliance fabric, and instant liquidity routing across every major stablecoin. Para’s makes these tokens as fluid as an email—instantly usable, anywhere, by anyone.

Nobody cares which logo sits on their stablecoin any more than they care which SMTP server delivers their email. Interoperable wallets can turn digital money into a truly open web of value—and the companies that enable that long-term future will own the rails of the next wave of our financial system. We’re at a critical fork into road between replicating existing systems with lip-service to open rails and building a more user-owned, open internet that makes it easier to move value.

If you’re issuing a stablecoin, building a wallet, or reconciling ten of them at checkout, let’s talk.