Programmable Money Movement: Unlocking Full Stablecoin Value

→ Onchain money is more powerful than offchain money.

→ It’s faster, programmable, and composable across apps, chains, and jurisdictions.

→ But today’s money movement is fragmented and lacks context.

→ Para and M0 fix this by making money movement a first-class primitive: programmable at the wallet layer, composable across infrastructure, and secure by default.

→ The result: Seamless flows that work for users, developers, and institutions alike.

Why Onchain Funds Are Significantly More Valuable

Offchain money moves in closed loops. Whether it’s ACH transfers, card rails, or mobile wallets, the flow is rigid, siloed, and manual. There’s no shared infrastructure across providers: no APIs for money, no composability, and no way to build logic into the movement of funds.

Onchain, money moves in open loops. Money is programmable. Money movement can happen instantly, across borders, with logic built in: time locks, access controls, provenance tracking, automated conversions.

The shift from static to programmable, and from siloed to composable, unlocks exponential value. To realize that value, ecosystems need infrastructure that makes money movement a first-class primitive: That’s where Para comes in.

Para makes money movement programmable. It gives ecosystems the ability to define how funds should move (across apps and chains) without needing to build and maintain custom integrations.

The Problem with Today’s Money Movement

Not all onchain funds are created equal, but most wallets act as if they are.

Regardless of how funds come onchain—whether via bridges, fiat ramps, airdrops, or in-app earnings, they land in the same wallet and are treated identically, without context or constraints.

To unlock the full potential of onchain money, we need to treat it like data with provenance, metadata, and rules. That’s what enables automation, security, and composability at scale.

Money Needs to Be Composable

In a truly open financial system, money should move as easily as data. Across apps, chains, and jurisdictions, with context preserved and rules enforced.

But today, each step in the flow often requires a bespoke integration. This fragmentation between on-ramps, wallets, and bridges creates cost, risk, and complexity, especially for institutions that need auditability and control at scale.

Users, meanwhile, want to move freely. They want to deposit via Apple Pay, use funds in a DeFi app, bridge to another chain, and then cash out—all within minutes. Infrastructure needs to match that flexibility without compromising on safety or compliance.

Platforms like Juicebox demonstrate what composable money looks like in practice: funds can be raised, routed, and distributed across contributors, treasuries, and apps, with rules and context preserved end-to-end rather than locked inside a single wallet or provider.

M0 and Composability: The Foundation of Programmable Money Movement

This is where composability comes in. With Para and M0, stablecoins powered by M0 are interoperable by default: any Minter on the network, whether it’s an app, ramp, or institution, can issue or redeem them without needing a custom integration or privileged role. This shared standard creates a universal interface for money.

Wrapping and unwrapping M0 powered extensions is also composable and built with standard logic that any developer can plug into. That means wallets, on/off-ramps, and other services can build once to access the entire ecosystem. If an app builds with M0, it automatically benefits from the full network of ramps, bridges, and extensions already supporting it.

This model turns stablecoins into infrastructure, making money movement a native part of app logic rather than a separate backend process.

Composability isn’t just a developer feature. It’s the key to building a money movement layer that’s secure, efficient, and future-proof.

Para: Smarter Money Movement

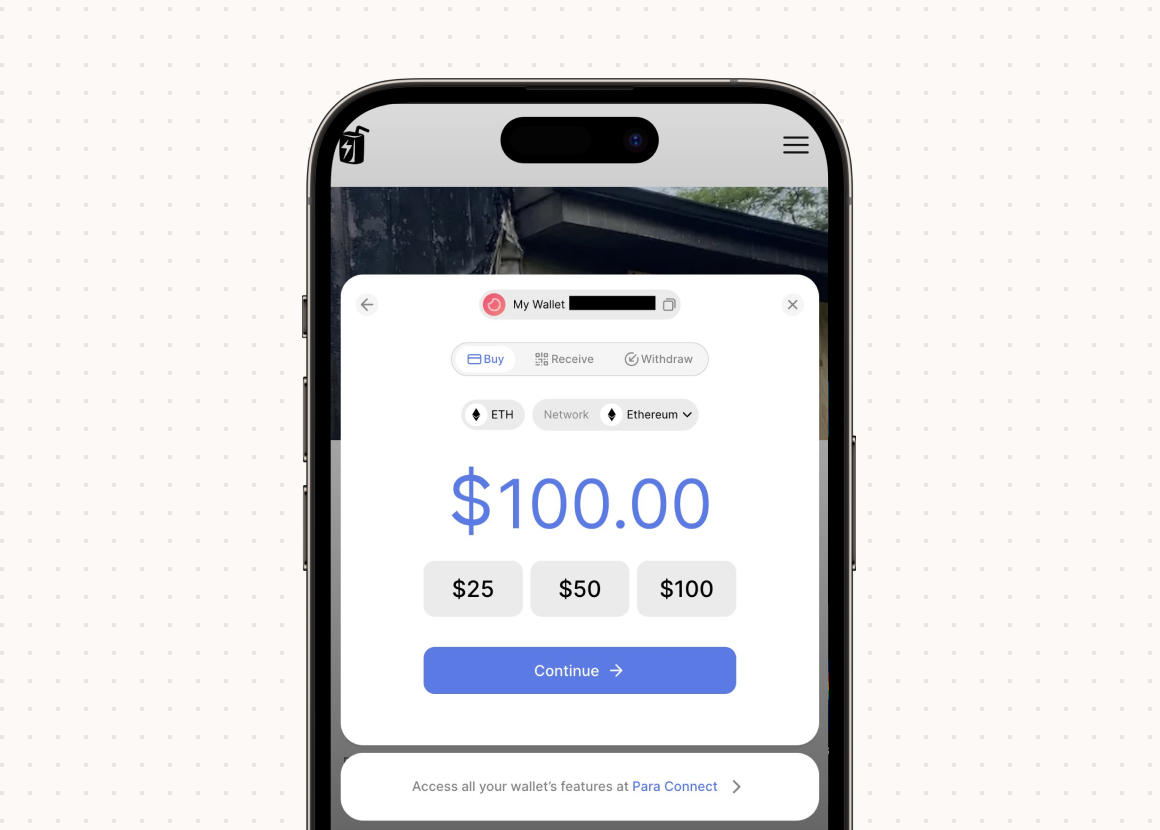

Para powers seamless money movement across apps. With built in on-ramps, off-ramps, and more, the Para SDK lets users moves funds seamlessly without any separate integrations required. Stablecoins like USDN on Noble show how this works in practice: compliant, scalable, and deeply integrated in an ecosystem for web3 and web2 users. Para’s SDKs are stateful and programmable, with Distributed MPC ensuring secure, flexible money movement behind the scenes.

Most fintechs or apps have to stitch together multiple providers – wallets, on-ramps, bridges – to control how money moves, often at the cost of UX. Para bundles this natively at the wallet layer so you can enforce rules without custom logic or added complexity. For example:

- Block risky smart contract interactions for freshly deposited fiat or bridged assets

- Apply asset-specific rules based on user behavior

- Enforce compliance and security constraints without degrading user experience

Crypto payment platforms like Qash show why money movement infrastructure matters: users expect fast, familiar payment flows, while operators need stablecoin routing, embedded wallets, and compliance-aware control. This all works without fragmenting funds across separate wallets, rails, or integrations.

We believe the future of money movement is programmable, composable, and secure by default. Infrastructure like Para and M0 makes that possible, turning complex UX into seamless experiences for developers and users.

Money Movement Use Cases

Para makes complex user stories safe and secure:

- Onboarding new users: Enable new users to create accounts and onramp assets from any local currency easily. Through the Para Developer Portal, you can enable best-in‑class onramps like MoonPay, Ramp and Stripe, with Apple Pay, card, and regional payment options baked in.

- Rule enforcement: Easily apply constraints (e.g., holding periods, provenance checks) to prevent abuse, such as laundering via small-cap tokens.

- Stablecoin routing: Use stablecoins like $M or $USDN as a composable intermediary, instantly wrapped, routed, and redeemed by any minter in the network.

This pattern already shows up in applications like Confetti, where funds move conditionally based on contest outcomes, timing, or governance decisions, illustrating why asset-level rules and programmable constraints matter for real onchain payouts.

What It Takes to Get Money Movement Right

Onchain money needs rules, context, and flexibility, not just faster transfers. Para provides the infrastructure to make that possible:

- Battle-tested wallet infrastructure

- Asset-level permissioning

- Seamless on-ramp and money movement via M0 and ecosystem partners

- A UX that hides complexity without sacrificing control

Programmable money movement isn’t just a feature; it’s the foundation for the next generation of financial systems.

Curious about money movement for your application? Let’s talk.